If you read my last article entitle Isolation Buckets in the Payment from Savings Banking Model, then you might realize that this post is a different topic than the essential role of the checking account that I said I would cover next. I will get back to that topic, but decided it was more important to cover paying bills with credit cards, and the difference between automatic and manual payments.

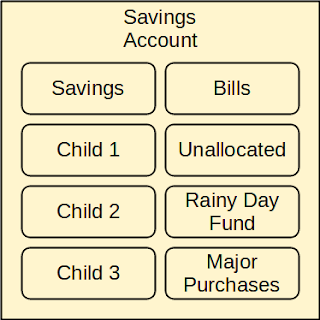

The diagram below is an extension of the diagram from that article mentioned above. It splits the Bills into Manual Bills and Automatic Bills, and adds the Credit Card and Purchases bubble. These are additions are the topic of this article.

.

What is a responsible credit card user?

Many people use credit cards, but not everybody should:

- If you do not understand how credit cards work, then you should not be using credit cards!

- If you do not pay your credit card statement balances in full each month, then you should not be using credit cards!

- If you routinely pay late fees and/or interest on credit cards, then you should not be using credit cards!

- If you are close to your maximum credit limit, then you should not be using credit cards!

- If you find yourself transferring debt around between different credit cards using balance transfer checks, then you should not be using credit cards!

- If you know you will not be able to control your spending on credit cards, then you should not be using credit cards!

- If you do not feel comfortable using credit cards, then you should not be using credit cards!

But, if you are a responsible credit card user, then you are probably already raking-in cash, travel points, store gift cards, etc., depending on which card or cards you use,

without paying an extra dime to the bank(s) that issued your credit card(s). For example, a

SoFi Credit Card holder enrolled in SoFi Plus could be making 3% on all credit card purchase transactions. If you are a responsible user that routinely makes money using credit cards, this article might provide you information about making even more money using credit cards by integrating them into the Payment from Savings Banking Model. Regardless, you will probably find the concepts of fixed-cost, variable-cost and occasional-cost bills useful.

Bills that are Fixed-Cost vs Variable-Cost vs Occasional-Cost

Whether you use credit cards or not, you probably have some fixed-cost bills, such as

- Loans (mortgage, car loan, etc.)

- Certain kinds of utilities (cell phone, internet)

Those bills are fixed-cost because the amount of the bill does not generally change from month-to-month. Although, even with such bills, the amount might still change occasionally. For example, your mortgage company might re-evaluate you escrows once or twice a year, and decide you owe more or less than what you were paying because the escrowed amount has changed. Similarly, if you Internet service is not locked-in, the cost of your Internet might go up over time.

You probably also have one or more variable-cost bills, such as

- Metered utilities (water, sewer, gas, electric, etc.)

- Credit cards

Those bills are variable-cost because the amount of the bill is almost always different. Water and electric might go up in the summer because of water the lawn and running the air conditioner, but gas might go up in the winter because of a gas furnace. The credit cards bills will vary often because of birthdays, Christmas, vacations, and unexpected situations such as car repairs and medical/dental expenses, as well as just big purchases for things you wanted or needed to buy. If you pay for groceries on a credit card, you have undoubtedly noticed a large increase in the statement balance each month over the past few years.

There are also bills that occur at a frequency that is less than once-per-month, and these are the occasional-cost bills:

- License plates are due once per year

- Car insurance (if you choose to pay every 6 months to take advantage of a discount)

- Life insurance (perhaps you have to pay the premium quarterly

Automatic Bill Pay vs Manual Bill Pay

Some -- if not most -- of your monthly bills can probably be setup for automatic payment. It can be a push payment, such as when you use your bank's bill payment feature to send a payment. Or, it can be a pull payment, such as when you schedule a payment on your credit card or utility company website to request money from your bank. Either way, the question is should you do automatic payments?

Whether the payment should be automatic or not depends on several factors:

- Is the bill fixed-cost, variable-cost, or occasional-cost?

- Will you be paying the bill with a credit card, or bank ACH?

If you are a responsible credit card user using the Payment from Savings Banking Model, the ideal situation would be to pay all bills automatically from the credit card, except for one bill per month which is a manual payment of the most recent credit card statement balance itself. However, that is rarely possible or practical. For example, you cannot generally use credit to pay installment credit, which means you will not be able to pay mortgage or car loan payments via credit card. Additionally, sometime there is a financial disadvantage involved with paying by credit card. My mobile phone company, for example, gives a $20 discount ($5/line/month) if I do automatic-pay using bank ACH; if I do not do automatic payment, or if I do automatic payment via debit or credit card, I do not get the $20 discount.

General Rules of Thumb

I have developed several general rules of thumb that help determine how specific bills should be paid. These work for me, and you should evaluate if they work for you.

- If you are a responsible credit card user and the bill allows automatic payments from credit card, and does not charge significantly more for paying the bill with a credit card, then setup automatic payment using a credit card.

- If the bill is fixed-cost and is not automatically charged to the credit card in point 1 above, then setup automatic payment using bank ACH from the savings account, if possible.

- As a last resort, use manual payment bank ACH from the savings account if you the bill is not automatically paid because of points 1 or 2.

These points are discussed in the sections below.

Automatic Bill Payment Using Credit Card

Automatically paying bills using a credit card is ideal. You will earn rebate/rewards points, per the terms of your credit card, for all of the bills you pay with the credit. For example, with the

SoFi Credit Card, if enrolled in the free SoFi Plus program, you could be earning 3% back on purchases for up to a year if you join SoFi Plus. Additionally, for any credit card, you will have 20-40 days of extra interest from the day the bill is paid using the credit card until the day you pay the credit card statement balance off using manual bank ACH.

There are other benefits, too. The credit card aggregates all of the bills together, so you just need to make sure the credit card itself gets the statement balance paid in full each month to ensure that you do not pay any late fees or interest. The monthly bills charged to the credit card can occur on any day, even weekends and holidays, so no bill paid with credit card should ever be late. Additionally, the credit card acts as a buffer -- since the statement will be available at least 20 days before the due date, you have a few weeks to figure out what to do if the bill is unusually high for some reason.

It should be noted that your first payment from you savings account to pay off your credit card statement balance might take a few extra days. This is because the credit card company will likely force you to validate the savings account before you can make a payment from that savings account. This validation typically involves the credit card making two different low-value deposits into the savings account, and then having to enter those specific values back into the credit card web site as validation that you have access to that account.

Even though payment of bills to the credit card is probably an automatic payment, paying the credit card statement balance the following month will be a manual payment using bank ACH from the savings account.

Automatic Bill Payment Using Bank ACH from the Savings Account

If the bill allows for automatic payment but you choose not to or cannot charge it to a credit card, the automatic billing with bank ACH is a good option. Note, however, that automatic payment of a variable-cost or occasional-cost bill via bank ACH is somewhat risky, as there is an increased chance that you might not have enough unvaulted funds within the savings account. Therefore, I personally use the automatic payment using bank ACH option for fixed-cost bills only.

Manual Bill Payment Using Bank ACH from the Savings Account

You probably have certain bills that you must schedule manually each month. Honestly, if you are doing things right, most of these will actually be payments of credit card statement balances. You still make interest up to the day the money is withdrawn, but have to schedule the payment each month. For credit cards, you would typically schedule the payments via the credit cards web site; that will ensure that the funds are not late, and get credited to the correct credit card account (some credit card banks let you manage multiple credit cards from the same online account).

Automatic vs Manual Funding

The sections above talk about automatic or manual bill payment. But it is just as important to consider automatic vs manual funding. The automatic or manual bill payment refers to whether you have a recurring scheduled payment, or have manually initiate the payment each month. The automatic vs manual funding refers to whether the money will automatically be available in the unvaulted savings when the payment is due, or whether you have to manually move money from the unallocated vault (or elsewhere) to the unvaulted savings before the payment occurs, regardless of whether it is schedule for automatic or manual payment.

- If you are charging bills to a credit card, you probably want manual bill payment, manual funding for that credit card statement balance.

- For those bills that are automatically paid via Bank ACH, you can choose whether you want automatic or manual funding.

- For those bills that are manual paid via Bank ACH, you probably want manual funding.

The manual funding is somewhat trivial. Basically, you have to track when the money is needed in the unvaulted savings account, and transfer money into that account from the unallocated account before the payment will be removed. The transfer only takes seconds, and it does not matter whether you do it early or wait to the last day, especially if you are making the same interest on both unvaulted funds and the unallocated vault.

The automatic funding is a bit trickier. Basically, you might need to setup you direct deposit to split your paycheck, or possibly setup day-of-month recurring transfers. For automatic funding, you need to plan automatic steps to ensure the amount to cover the automatic bill payment is in the unvaulted savings on time.

Additional Considerations When Paying Bills from Credit Cards

There are several other things to consider when paying bills with credit cards, and they are summarized below.

Consider Paying Bills with a Dedicated Credit Card

If you are going to regularly pay bills with your credit card, you might consider using a dedicated card. In this case, there is nothing special about the card itself -- it can be an old credit card, but preferably one that earns some good rewards or points. But, you might want to use that card only for bill payments, and use a different card for purchases.

Using a dedicated credit card for bills just make sense. This is because it provides an easy way to check if it is working. Every month when you log in to get the statement balance, you can take a quick look at the transactions and see that all of the bills are actually be charged to the credit card. Additionally, if your purchases are a bit high for some month, you can be assured that the dedicated bill pay credit card has the statement balance paid in full, even if you enter the unfortunate scenario of not being able to fully pay the credit card you use for purchases.

Consider Using a Non-Working Spouse's Credit Card for Bills

If you have a non-working spouse (i.e. a wife that is a stay-at-home mom, etc.) and that spouse already has a credit card, your might want to charge all of the monthly bills to that credit card. This is especially true if the non-working spouse is on the card but the working spouse is not. The major benefit of doing this is to maintain excellent credit history for the non-working spouse in the event that something happens to the working spouse.